About

The Fire & Police Pension Association provides retirement and death & disability benefits for firefighters, police officers, and other first responders throughout the state of Colorado.

FPPA also administers local pension funds for some police and fire departments, as well as volunteer fire defined benefit plans. In addition, police and sheriff departments who participate in Social Security can affiliate for supplemental coverage through the Statewide Retirement Plan and Statewide Death & Disability Plan.

FPPA is a state government organization of about 70 staff located in the Denver Tech Center.

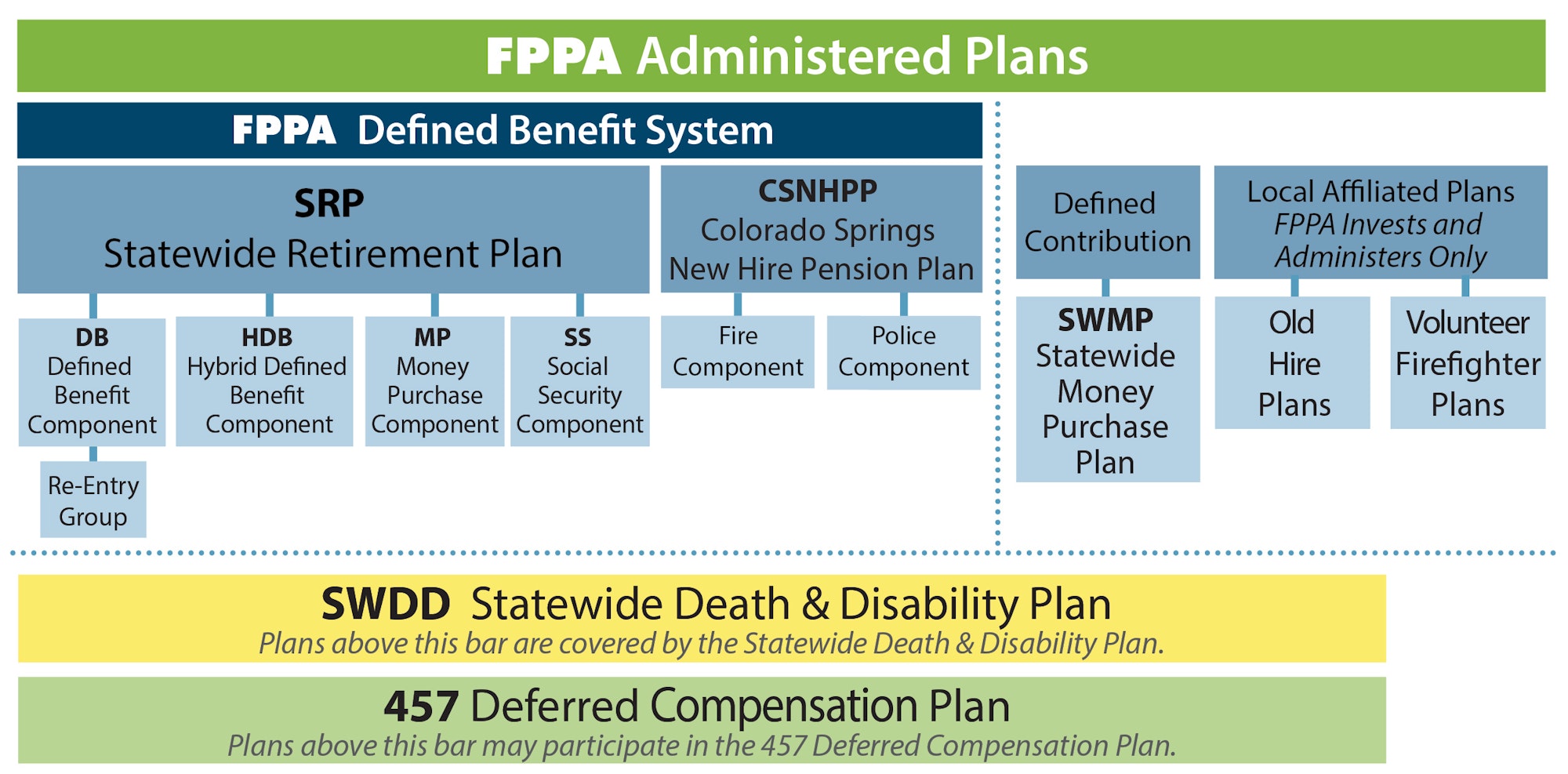

The Fire & Police Pension Association of Colorado (FPPA) collects, invests, administers, and disburses retirement funds for Members of these Plans:

- FPPA Defined Benefit System:

- The Statewide Retirement Plan (SRP):

- Defined Benefit Component

- Hybrid Defined Benefit Component

- Money Purchase Component

- Social Security Component

- The Colorado Springs New Hire Pension Plan (CSNHPP): which covers Colorado Springs firefighters and police officers hired before October 1, 2006

- Fire Component

- Police Component

- The Statewide Retirement Plan (SRP):

- The Statewide Death & Disability Plan (SWDD)

- The Statewide Money Purchase Plan (SWMP)

Affiliated local plans include:

- Local defined benefit pension plans for Colorado firefighters and police officers hired before April 8, 1978 (old hires)

- Volunteer firefighter defined benefit pension plans

FPPA pools pension plan assets for investment purposes. However, all plan-specific transactions (contributions, retirement benefit payments, refunds, etc.) are accounted for by plan. Affiliated old hire and volunteer plans are still governed by their local plan document and local pension board, and each has a separate actuarial valuation done every two years. Only the Statewide Retirement Plan, the Colorado Springs New Hire Pension Plan, the Statewide Money Purchase Plan, and the Statewide Death & Disability Plan are governed by the FPPA Board of Directors.

FPPA partners with Fidelity Investments to cover the Statewide Money Purchase Plan, 457 Deferred Compensation Plan, Deferred Retirement Option Plan (DROP), and the Money Purchase Component of the Statewide Retirement Plan.