Cost of Living Adjustments: SRP

Cost of Living Adjustments (COLAs) are increases to monthly benefit payments, intended to offset economic inflation. They are a feature of some defined benefit retirement plans like Social Security and public and private pensions. One-Time Lump Sums have a similar intention, but are single payments that do not affect Members’ regular monthly benefit amount.

In the Statewide Retirement Plan, these benefit adjustments are not guaranteed, and are paid based upon what the Plan can afford while maintaining a fully-funded status. As a fiduciary, FPPA is obligated to work in the best financial interest for all Plan Members. For this reason, FPPA has never guaranteed COLAs or One-Time Lump Sums to Plan Members.

In recent years, we have heard Members’ frustrations surrounding COLAs. Rest assured that FPPA takes those concerns seriously, and we are working towards providing more meaningful COLAs in the future.

COLAs and One-Time Lump Sums in the Statewide Retirement Plan

Eligible payees in the Statewide Retirement Plan may receive COLAs and One-Time Lump Sum payments in years when they are granted. COLAs are evaluated each June, and if approved by the Board of Directors, are effective with payees' October benefit payment.

Eligibility

Members become eligible for COLAs and One-Time Lump Sums once they have received retirement benefits for at least 12 calendar months prior to October 1. For example, if a Member retires in July, they will be eligible for their first Cost of Living Adjustment in October of the following year. Alternatively, if a Member retires in November, they would reach COLA eligibility nearly two years into retirement. COLAs, if awarded, are effective October 1.

COLAs in the Statewide Retirement Plan are not guaranteed and are not a fixed amount. They are set annually by the FPPA Board of Directors. COLAs may be any amount, up to the rate of inflation (Measured by CPI-W) or 3%, whichever is greater.

The actual COLA is determined based on a calculated amount that:

- Can be paid to all Plan Members each year in perpetuity, and

- Results in a 100% funded status to protect base benefits

Effective in 2023, FPPA’s Board may also consider granting non-compounding, One-Time Lump Sum payments to eligible payees. One-Time Lump Sums are payable only if certain conditions are met and may be paid in addition to any approved COLA. Eligibility requirements and effective dates for One-Time Lump Sums are the same as those for COLAs, described above. One-Time Lump Sums, if awarded, are included in the payee’s October payment.

One-Time Lump Sum amounts are calculated by subtracting the approved COLA percentage from the CPI-W inflation rate for the previous year. The resulting percentage is then multiplied by the Member’s annual benefit.

Example: In a year where the CPI-W rate was 2.5% , and the approved COLA was 0.3%, the One-Time Lump Sum would equal 2.2% of each eligible payee’s annual benefit (2.5% - 0.3% = 2.2%). In this example, a Member receiving a $20,000 annual benefit would receive a One-Time Lump Sum of $440 ($20,000 x 2.2% = $440) with their October payment.

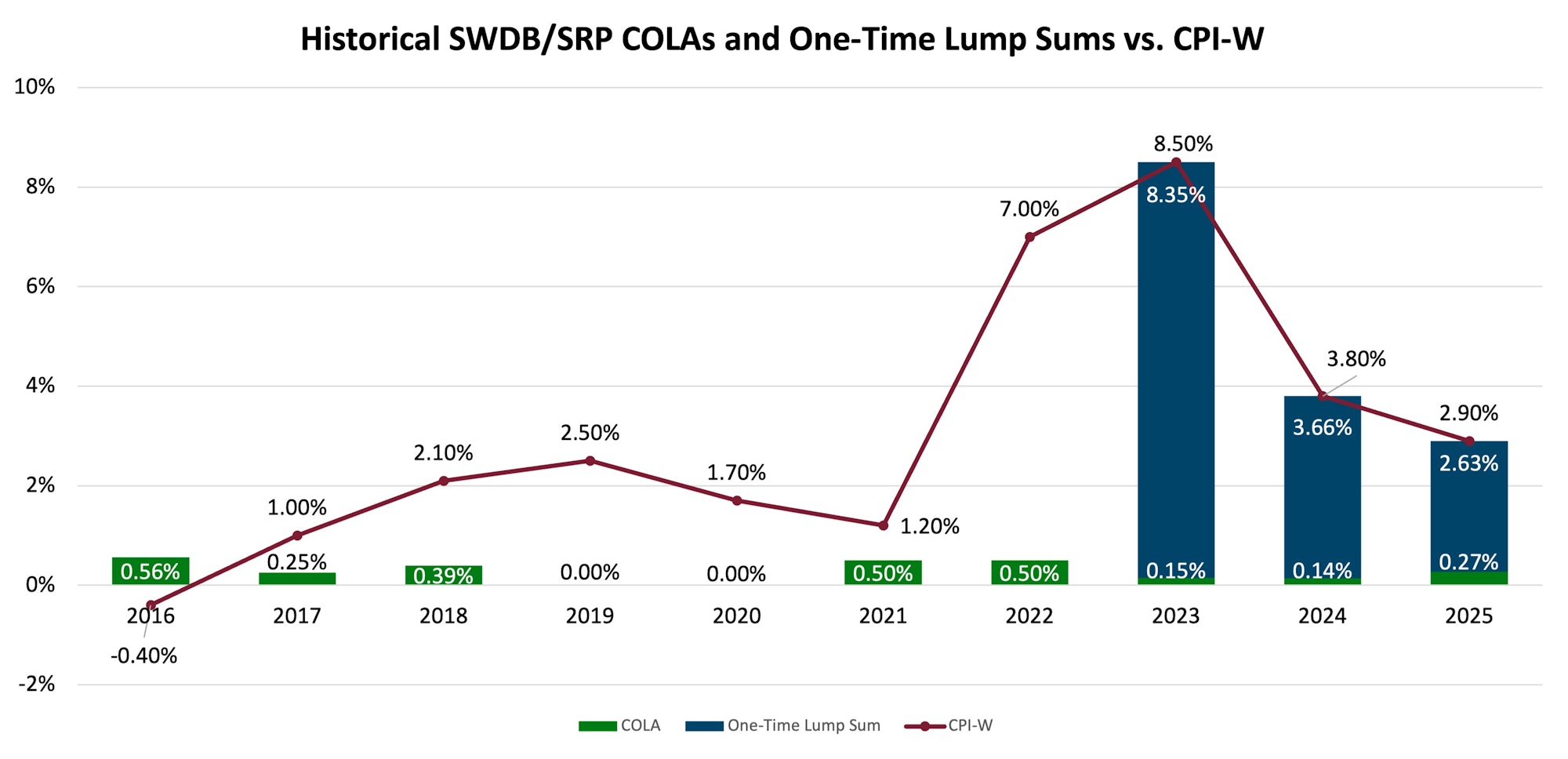

Recent Statewide Retirement Plan COLAs and One-Time Lump Sums

The chart and data set below shows Cost of Living Adjustments and One-Time Lump Sum payments over the past ten years.

| Year | CPI-W Inflation Rate | Approved COLA | Approved One-Time Lump Sum |

|---|---|---|---|

| 2016 | -0.40% | 0.56% | N/A |

| 2017 | 1.00% | 0.25% | N/A |

| 2018 | 2.10% | 0.39% | N/A |

| 2019 | 2.50% | 0.00% | N/A |

| 2020 | 1.70% | 0.00% | N/A |

| 2021 | 1.20% | 0.50% | N/A |

| 2022 | 7.00% | 0.50% | N/A |

| 2023 | 8.50% | 0.15% | 8.35% |

| 2024 | 3.80% | 0.14% | 3.66% |

| 2025 | 2.90% | 0.27% | 2.63% |